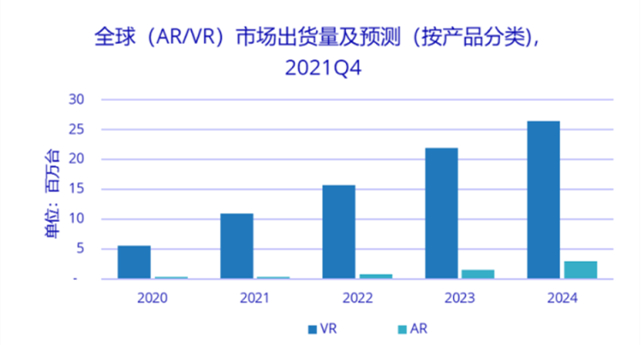

According to IDC’s “Global AR/VR Headset Market Quarterly Tracking Report, Q4 2021″, the global AR/VR headset shipments will reach 11.23 million units in 2021, a year-on-year increase of 92.1%, of which VR headsets will be shipped The volume reached 10.95 million units, of which Oculus’ share reached 80%. It is estimated that in 2022, the global VR headset shipment will be 15.73 million units, a year-on-year increase of 43.6%.

IDC believes that 2021 will be the year when the AR/VR head-mounted display market will explode again after 2016. Compared with five years ago, in terms of hardware equipment, technical level, content ecology, and creation environment, compared with five years ago, it has With the substantial improvement, the industry ecology is healthier and the industry foundation is more solid.

However, due to the late start of the VR industry, the product lines of various manufacturers are not long. From the perspective of the global market, the Oculus Quest series and Sony PSVR series are still the leaders of the track. At the same time, games are still the main scene of VR headsets at this stage.

Take Oculus’ content store as an example, most of the applications it provides are related to games. As for Sony’s PSVR, it is a game accessory for Sony’s PlayStation.

According to public information provided by foreign market research agencies, as of 2018, PS4 sales in the United States ranked first in the world, with more than 30 million units, equivalent to one-third of the total global sales. Its sales ranked second in the world in Japan with 8.3 million units, Germany and the United Kingdom with 7.2 million and 6.8 million units respectively.

Objectively speaking, VR games are indeed the applications that best reflect the sense of immersion and experience of VR devices; on the other hand, games are also the fastest way to realize cash flow and return cash flow at the current VR consumer end.

However, in the domestic market, mobile game players are the mainstream game players, and game console players are always in the minority.

This has also led to the fact that game consoles paired with VR headsets are very common in overseas home entertainment scenarios, but are not the mainstream demand in the domestic market.

At present, in terms of game scenarios, domestic brands are more likely to use preferential policies to attract users. In 2021, the C-end of the domestic VR all-in-one market will account for 46.1%.

Taking the domestic consumer-grade VR headset manufacturer Pico as an example, when it launched the latest generation of Pico Neo3, it launched the “180-day check-in and half price” event. After activating the headset, users can play VR games for half an hour every day for 180 days to get half of the cash back on the purchase price.

As for iQIYI’s VR headset, IQiyu VR, it directly reduced 30 mainstream VR games worth nearly 2,000 yuan to 0 yuan, and launched a “300-day check-in and full payment” campaign for specific models.

Although limited-time free games can be a means of attracting users for VR headsets, the most important thing for VR headsets is to get out of the game user group and provide a more popular “irreplaceable” experience.

However, driven by the concept of the metaverse, there will be many changes in the Chinese market in the future

IDC analysts said that the pace of new product releases of major brands in the Chinese market has accelerated, prices have dropped significantly, hardware manufacturers have increased investment in content ecology, diversified marketing models, and diversified sales channels.

Industry insiders told reporters that although Oculus Quest 2 has not yet entered the Chinese market to make room for development for domestic brands, in order to compete with Oculus, Sony and other companies, it is necessary to continue to make efforts in the construction of VR content ecology , in order to have more voice in the new competitive landscape.

Post time: Apr-22-2022